If you have financial accounts or other assets you haven’t checked on recently, be forewarned: the clock may be ticking for those assets to be seized by state government if not claimed.

All 50 states and the District of Columbia have laws and policies governing the disposition of unclaimed property. These laws are intended as a consumer protection measure to ensure a good faith effort is made to return unclaimed money or other assets to its rightful owner (either because it’s forgotten or you were unaware it was yours).

The states have programs to identify rightful owners of assets and reconnect them with their property. And the numbers are substantial: in fiscal year 2015, the latest year for which numbers are available, state government officials nationwide returned over $3.2 billion worth of unclaimed property to the rightful owners, according to the National Association of Unclaimed Property Administrators (NAUPA). NAUPA estimates the states hold a jaw-dropping $43 billion in total unclaimed property.

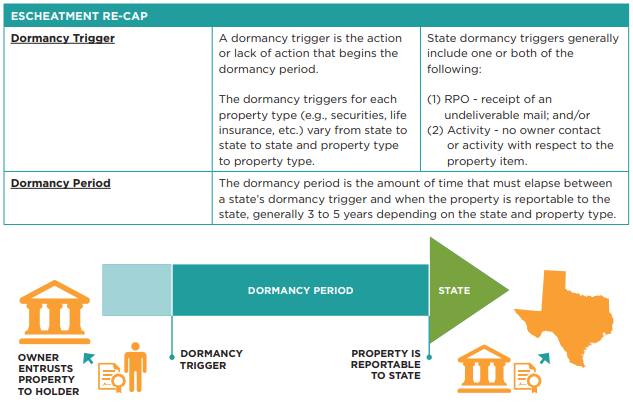

Assets at risk for being called dormant – and sent to the state – are those that have passed a dormancy trigger and have stayed dormant for a period called a dormancy period. A dormancy period can be something that has happened with respect to the property (e.g., receipt of an undeliverable mail or “RPO” notice), or something that has not happened (e.g., no owner contact or activity with respect to the property item). If the dormancy period passes without the owner reestablishing contact with the holder, then the holder of those assets, often a broker dealer, will send dormant assets to the state. Financial assets that are sent to the state are quickly liquidated the state treasury, while physical assets will typically be auctioned off with the proceeds going to the state treasury (you’ll also see the process described by the formal legal term, “escheatment”).

Dormancy periods vary by state, so recognize that the clock may be ticking on property you may own but have not yet claimed. Moreover, many states have shortened the dormancy period for seizing unclaimed assets, so time is of the essence—don’t delay if you want to be sure of getting what’s rightfully yours.

Which means that as an investor and consumer, you want to double check to make sure you’ve claimed what’s yours. Whether it’s a bank account, cash, tax refund, safety deposit box, retirement account, jewelry, insurance payment, inheritance, dividend check, utility deposit or other asset, you want to be sure you assert ownership of what belongs to you.

Fortunately, that process is easier today, thanks to online databases and search technology. To find out if you have unclaimed property listed in your state or elsewhere, NAUPA offers two free online tools that can help you identify what’s yours:

- To search on a particular state, visit https://www.unclaimed.org/ (be sure to check all states in which you have lived in the past as well as your current state or residence).

- To conduct a nationwide search, visit http://missingmoney.com/.

Once you’ve checked to see if there’s unclaimed property in your name, it’s a good idea to have a strategy going forward to ensure the lines of ownership for all your assets are up to date, especially if you’ve changed addresses or changed your name or marital status.

A recent briefing from the Financial Industry Regulatory Authority (FINRA) offers a useful checklist to ensure the personal contact information on your account listings is current and to protect yourself against potential escheatment proceedings:

- Notify your financial institutions of any changes to your contact information, including email and snail mail addresses. Do so even if you primarily view your account information online. Call your firm if you fail to receive account statements or other information you normally receive.

- Take action if you receive any calls asking that you update your mailing address, email address or other contact information. To guard against identity theft, you might prefer to thank the caller and then contact the institution on your own to verify that it requested the update.

- Consider consolidating small accounts to reduce management tasks and to limit your chances of forgetting an account.

- Check in with your financial institutions at least once each year by phone, email or in person.

- Periodically check the unclaimed property database of the state you currently live in and any states where you once lived.

- Check the unclaimed property listings for the states of Delaware, Massachusetts and Maryland, where many financial firms are registered. Note: Some dormant accounts may be listed at the firm’s address instead of the account holders.

- Be attentive to mailings from institutions with which you may not be familiar. Financial firms are rebranded, bought, sold or go out of business on a regular basis.

- Be open to the possibility that you might also be contacted by a firm handling the affairs of relative or acquaintance. You might be the recipient of their bequest without realizing you were included in their will or estate.

- Contact your financial institution to determine how it interprets the laws in your state. For instance, ask how your institution handles automatic contributions. Some states do not count regular automatic account deposits or withdrawals as active management.

Finally, beware of fraud schemes related to unclaimed property. While there are legitimate businesses that focus on reconnecting owners with unclaimed property (for a fee), watch out for unscrupulous players that attempt to exploit you or maneuver you into surrendering a payment or personal information. If you’ve been contacted by an outside party regarding unclaimed property, NAUPA suggests you reach out to the unclaimed property office in your state for more information before doing business with them.

Check out FINRA’s full bulletin for more. Then take the steps needed to check and be sure you don’t have unclaimed financial accounts or other property coming to you. You might even be in for a pleasant surprise.

Further reading on unclaimed property laws