Overview

After you decide to invest in bonds, you then need to decide what kinds of bond investments are right for you. Most people don’t realize it, but the bond market offers investors a lot more choices than the stock market.

Depending on your goals, your tax situation and your risk tolerance, you can choose from municipal, government, corporate, mortgage-backed or asset-backed securities and international bonds. Within each broad bond market sector you will find securities with different issuers, credit ratings, coupon rates, maturities, yields and other features. Each one offers its own balance of risk and reward.

Use this section to clarify the differences among your bond investment alternatives:

- Learn the ins and outs of different types of bonds in the comprehensive “Investor’s Guides” to various types of bonds

- Supplement your knowledge with product-focused industry research and articles

- Find out more about bond funds

To purchase Investor Guides in digital format as a site license, please visit: www.sifma.org/store.

Introduction to Zero-Coupon Municipal Bonds

Municipal bonds—sometimes known as “munis”— are debt obligations issued by state and local governments, as well as agencies and authorities like school districts and public utilities, to fund public projects. Munis are a vital public financing tool, providing a mechanism through which more than 50,000 U.S. state and local governments, and government agencies, raise money for public projects like water and sewer systems, schools, highways, transportation facilities, public buildings and much more.

At the same time, a municipal bonds investment may be considered by investors who seek stability, steady returns and tax benefits is exempt from federal income taxes. In most states, interest income received from bonds issued by governmental entities within the investor’s own state is also exempt from state and local income taxes (check with a tax or financial professional about your state).

According to the Federal Reserve, individual ownership of municipal bonds was approximately $1.6 trillion at the end of 2017.

HOW ZERO-COUPON MUNIS WORK

Most municipal bonds provide cash interest payments to the investor on a semiannual basis. However, zero-coupon municipal bonds are different: they offer no periodic interest payments, or “coupon,” as their name suggests. Instead, at maturity, the zero-coupon municipal bond investor receives a single payment comprising the principal invested plus the interest earned, compounded semiannually, at the stated yield.

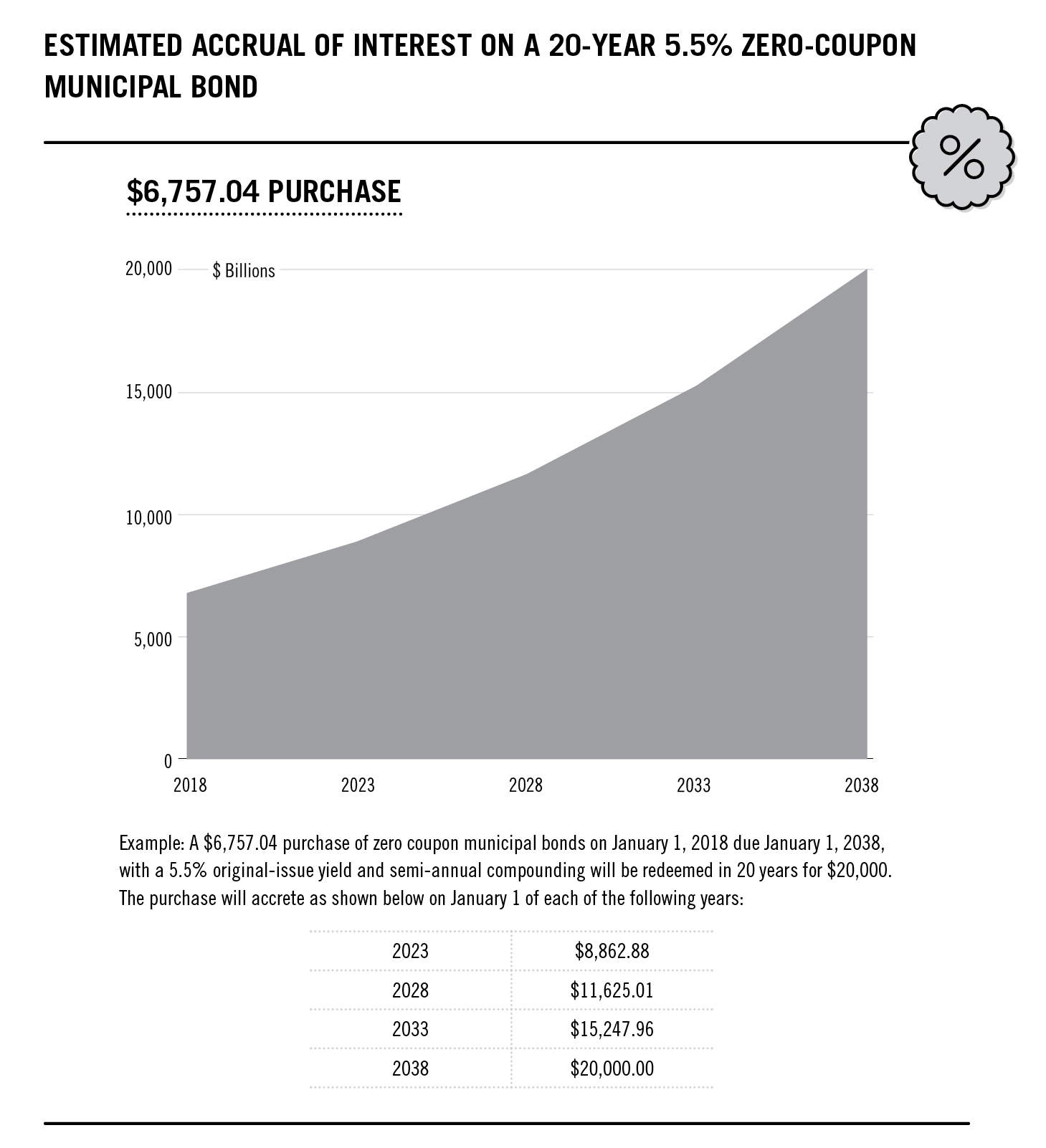

Zero-coupon bonds are sold at a substantial discount from the face value. For example, a bond with a face value of $20,000, maturing in 20 years with a 5.5% coupon, may be purchased at issuance for roughly $6,757. At the end of the 20-year investment, the investor will receive the full $20,000 face value. The difference between the initial $6,757 and the ultimate $20,000 payment represents the interest that compounds automatically until the bond matures (as illustrated in the example, Estimated Accrual of Interest on a 20- Year 5.5% Zero-Coupon Municipal Bond).

How Large is the Zero-Coupon Municipal Bond Market?

In 2017, there were 125 new issues totaling $1.4 billion. $71.4 billion of zero-coupon municipal bonds have been issued in the past ten years.

Features of Zero-Coupon Municipal Bonds

Zero-coupon municipal bonds combine the benefits of the zero- coupon debt instrument with those of tax-exempt municipal securities.

TAX BENEFITS

Because the interest paid by zero-coupon municipal bonds is exempt from federal income taxes, these bonds provide returns that are often higher on an after-tax basis than comparable taxable securities. To see the difference with tax-exempt interest, refer to the Tax-Exempt / Taxable Yield Equivalents chart.

Further, tax-exempt zero-coupon municipal bonds earn interest that, in many cases, is also free from state and local taxes. (Certain out-of-state municipal bonds may be taxable at the state level. Check with a tax or financial professional.)

In contrast, taxable zero-coupon bonds (like corporate bonds) are taxed each year on the amount of interest that has accrued for that year (unless held in a tax-deferred account), even though the accrued interest is not paid to investors in that year.

If an investor sells a zero-coupon municipal bond at a price that is higher or lower than the price at which it was purchased plus accrued interest, that investor might incur a capital gain or loss, as with any other fixed income investment. Be aware that a capital gain or loss may trigger additional tax implications.

MITIGATING REINVESTMENT RISK

Zero-coupon municipal bonds provide investors with the opportunity to lock in a specified rate of return, without having to worry about reinvestment risk or future interest rate changes.

By contrast, investors in securities that pay interest semiannually may not always achieve a total realized compounded yield equal to the quoted yield to maturity they expected when they purchased their holdings. Depending on future prevailing interest rates, their interest payments may be reinvested in lower or higher yielding vehicles.

FLEXIBILITY IN MATURITY

Zero-coupon municipal bonds offer a wide choice of maturity horizons, which can be helpful to investors with different investing goals. There are zero-coupon municipal bonds available with maturities ranging from one to 40 years, with the majority of these bonds having maturities between eight and 20 years.

CREDIT QUALITY

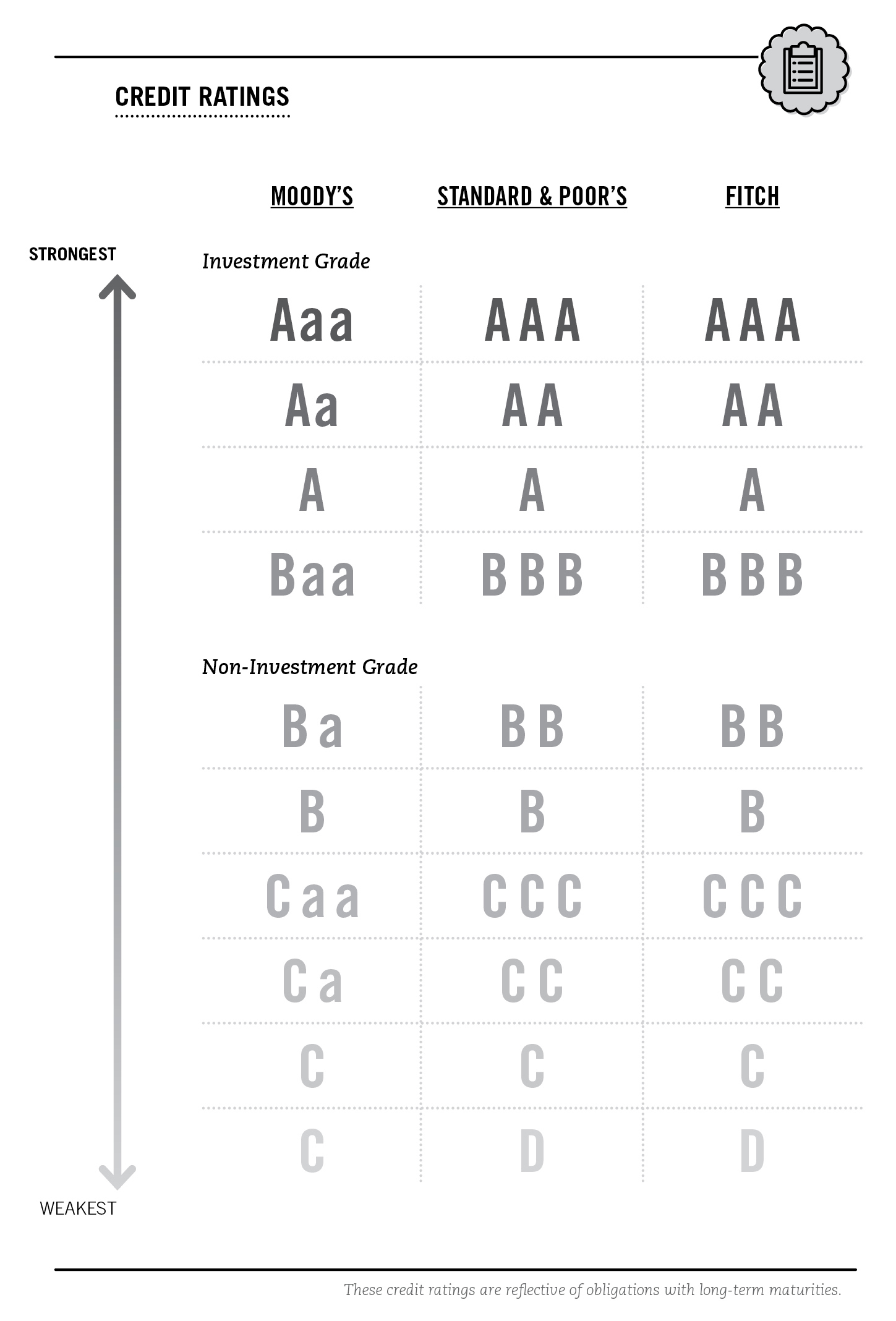

Most zero-coupon municipal bonds are rated A or better by the three major rating services: Moody’s Investors Service, Standard & Poor’s and Fitch Ratings (see How to Assess a Bond’s Risk). Some zero-coupon municipal bonds carry insurance to guarantee the payment on the bonds. Such a guarantee is based on the claims paying ability of the insurance company. Keep in mind that credit ratings are only one factor to consider when assessing a bond investment and should not be the sole basis for any investment decision.

LIQUIDITY

If you decide to sell your zero-coupon bonds before they mature, you may do so in the secondary market at prevailing market prices (refer to Market Risk).

Other Types of Zero-Coupon Municipal Bonds

Two additional variations of zero-coupon municipal bonds are “convertible zero-coupon municipal bonds” and “stripped municipals.”

CONVERTIBLE ZERO-COUPON MUNICIPAL BONDS

These bonds are sold as zero-coupon municipal bonds and then, generally after eight to 15 years, convert to interest-paying bonds.

STRIPPED MUNICIPALS

Municipal bonds that pay interest semiannually can be separated, or “stripped,” into their principal and the interest components. The cash flow of the coupons is repackaged into stripped municipals with a greater variety of maturities from six months to 40 years. Like other zero-coupon bonds, stripped municipals are issued at a deep discount from face value and are available with a wide range of credit ratings.

How to Assess a Bond’s Risk

CREDIT RISK

For municipal bonds of any kind, credit risk is determined by the financial and operating stability of the state or local government entity that issued the bond or the entity that is obligated to pay the principal of and interest on the bonds.

Risk assessment is particularly important for zero-coupon municipal bonds since all your principal investment returns will be paid at maturity. You should assess the creditworthiness of a zero-coupon municipal bond the same way you would assess any municipal bond.

Most new issues of municipal securities are originally offered by means of disclosure documents (called official statements or offering documents) that describe in detail the financial condition of the issuer or the entity responsible for making payments on the bonds.

From these disclosure documents, which are available through the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access (EMMA) portal at emma.msrb.org, investors can determine the risks involved in the investment. In assessing the relative quality of zero-coupon municipal bonds, investors may consider the ratings provided by one or more of the three major rating agencies, which have established the following classifications:

Generally, bonds that are rated at least BBB or Baa by Standard & Poor’s and Fitch Ratings or Moody’s, respectively, are considered to be “investment grade.” Bonds with lower ratings indicate a higher degree of risk.

The rating agencies grade bonds according to their investment qualities, but do not intend the rating to be the sole basis for an investment decision. The ratings cannot, for example, forecast market trends or interest rate changes that may affect a bond’s value. Before purchasing any bonds, particularly those with lower ratings, talk with a financial professional to make sure the bonds are appropriate for your investment goals.

BOND INSURANCE

Some municipal bonds are backed by municipal bond insurance specifically designed to reduce investment risk. In the event of payment default by the issuer, an insurance company – which guarantees payment – will send you both interest and principal when they are due. As stated earlier in this guide, such a guarantee is based on the claims paying ability of the insurance company.

MARKET RISK

As with all fixed-income securities, the price of zero-coupon municipal bonds fluctuates, usually in response to changes in market rates. While the interest on a bond is fixed by the price you paid, newer bond issues may be offered at higher or lower interest rates, depending on prevailing interest rates when they were issued.

Like other bonds, the values of zero-coupon municipal bonds move inversely to the movement of interest rates. That is, bond values increase as interest rates decline, and bond values decrease as interest rates increase.

As a result, zero-coupon municipal bonds that were purchased when interest rates were higher and sold in the secondary market when interest rates are lower will generate capital gains. Conversely, investors who sell their bonds during periods of rising interest rates will incur capital losses.

CALL RISK

Many municipal bond issues allow the issuer to call (or redeem) all or a portion of the bonds at a premium or at par before the bonds matures. An issuer may choose to call a bond issue when interest rates decline, for example, in order to refinance the bonds at a lower rate.

When investors purchase bonds, dealers will quote the yield to the call date if it is less than the yield to maturity. Therefore, an investor can know what the return on the bond will be if the issuer exercises its right to call the bonds.

Typically, zero-coupon municipal bonds containing call provisions provide that the bonds may be called at the option of the issuer on a specific date at a price or premium based on the accreted value of the security that was established at the time of issuance (known as the original accretion rate).

Before investing in any bond, pay careful attention to the call provisions. Furthermore, investors purchasing bonds at a premium in the new issue or secondary market should use care when paying prices in excess of an issue’s original accretion rate, because a call may result in a lower than expected yield or even a loss.

Investing in Zero-Coupon Municipal Bonds

Zero-coupon municipal bonds offer certain tax features that can be attractive to investors seeking long-term capital accumulation for retirement, education funding or other long-range savings goals.

Individuals can time the maturity of their investment to match their future needs, which may include:

- Retirement planning — Zero-coupon municipal bonds can be used to supplement a retirement savings program. However, they are not typically suitable for inclusion in Individual Retirement Accounts (IRAs) or qualified pension plans, because these plans already have their own tax benefits.

- Education funding — A portfolio of zero-coupon munis can be structured to mature during a child’s or grandchild’s college years.

- Gifting — Assets gifted today under the current annual estate and gift-tax exclusion of $15,000 per person can continue to grow with the tax benefits of zero-coupon municipal bonds. (If gifting assets to minor children, be aware of the so-called “Kiddie Tax.” Under the 1986 Tax Reform Act, Uniform Gift to Minors Accounts generating more than $2,100 in annual income for minors under the age of 18 are taxed at the parents’ or guardians’ rates.)

Tax-Exempt / Taxable Yield Equivalents

The table that begins on the following page will help you determine the yield you require from a taxable investment to equal the yield on a tax-exempt bond. The table is for illustrative purposes only and is not intended to represent a specific security. To use the table most effectively, follow the directions under the chart. You may also look online for yield calculators that can help you determine bond yields.

Note: SIFMA does not provide tax advice, and this is not intended to be a substitute for a consultation with a tax professional who knows the characteristics of the bond and your tax circumstances. You should always consult with a tax professional when considering an investment in fixed income securities, such as zero-coupon municipal bonds.

TAX-EXEMPT / TAXABLE YIELD EQUIVALENTS FOR TAX YEAR 2018

| TAXABLE | INCOME* | ||||||

| Tax brackets – single return | Up to $9,525 | $9,526 to $38,700 | $38,701 to $82,500 | $82,501 to $157,500 | $157,501 to $200,000 | $200,001 to $500,000 | over $500,000 |

| Tax brackets – joint return | Up to $19,050 | $19,051 to $77,400 | $77,401 to $165,000 | $165,001 to $315,000 | $315,001 to $400,000 | $400,001 to $600,000 | over $600,000 |

| Federal income tax rates | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

| TAXABLE YIELD | EQUIVALENTS (%) | ||||||

| Tax-exempt yields (%) | |||||||

| 1.00% | 1.11% | 1.14% | 1.28% | 1.32% | 1.47% | 1.54% | 1.59% |

| 1.50% | 1.67% | 1.70% | 1.92% | 1.97% | 2.21% | 2.31% | 2.38% |

| 2.00% | 2.22% | 2.27% | 2.56% | 2.63% | 2.94% | 3.08% | 3.17% |

| 2.50% | 2.78% | 2.84% | 3.21% | 3.29% | 3.68% | 3.85% | 3.97% |

| 3.00% | 3.33% | 3.41% | 3.85% | 3.95% | 4.41% | 4.62% | 4.76% |

| 3.50% | 3.89% | 3.98% | 4.49% | 4.61% | 5.15% | 5.38% | 5.56% |

| 4.00% | 4.44% | 4.55% | 5.13% | 5.26% | 5.88% | 6.15% | 6.35% |

| 4.50% | 5.00% | 5.11% | 5.77% | 5.92% | 6.62% | 6.92% | 7.14% |

| 5.00% | 5.56% | 5.68% | 6.41% | 6.58% | 7.35% | 7.69% | 7.94% |

| 5.50% | 6.11% | 6.25% | 7.05% | 7.24% | 8.09% | 8.46% | 8.73% |

| 6.00% | 6.67% | 6.82% | 7.69% | 7.89% | 8.82% | 9.23% | 9.52% |

| 6.50% | 7.22% | 7.39% | 8.33% | 8.55% | 9.56% | 10.00% | 10.32% |

| 7.00% | 7.78% | 7.95% | 8.97% | 9.21% | 10.29% | 10.77% | 11.11% |

| 7.50% | 8.33% | 8.52% | 9.62% | 9.87% | 11.03% | 11.54% | 11.90% |

HOW TO USE THIS CHART:

1. Find the appropriate return (single or joint).

2. Determine your tax bracket by locating the taxable income category that you fall into. Taxable income is income after appropriate exemptions and deductions are taken. (The chart does not account for special provisions affecting federal tax rates, such as the Alternative Minimum Tax.)

3. The numbers in the column under your tax bracket give you the approximate taxable yield equivalent for each of the tax-exempt yields in the near left column.

For example: If you are single and have a taxable income of $92,000 ($175,000 if married filing jointly), you would fall into the 24% tax bracket. According to the chart, you would need to earn 5.26% on a taxable security to match a 4% yield from a tax-exempt security.

* The income brackets to which the tax rates apply are adjusted annually for inflation. Those listed above are for 2018.

The above chart also reflects the tax brackets and rates of the Tax Cuts and Jobs Act, which was signed into law on December 22, 2017 and is effective from January 1, 2018.

Your individual tax circumstances can/may affect your effective marginal tax rate.

Glossary

Accreted value. The current value of a zero-coupon municipal bond, taking into account interest that has been accumulating and automatically reinvested in the bond.

Alternative Minimum Tax. The AMT is a secondary income tax system, which has its own set of rates and rules, separate from regular income tax. Taxpayers are required to determine their tax liability under both the regular income tax and the AMT and

to pay whichever is greater. Under the AMT certain deductions and exemptions are disallowed, including the exemption for interest on private activity municipal bonds.

Bond. A debt security in which the issuer pays to the investor the principal amount plus interest due on a specific date.

Callable bonds. Bonds that are redeemable prior to the specified maturity date at a specified price at or above par (or at or above their accreted value, for zero- coupon bonds).

Default. A failure by an issuer to: (i) pay principal or interest when due, (ii) meet non-payment obligations, such as reporting requirements or (iii) comply with certain covenants in the document authorizing the issuance of a bond (an indenture).

Discount. The amount by which the purchase price of a bond is less than the principal amount or par value. In the case of a zero-coupon bond, a discount is measured from the accreted value as determined at the original issuance.

Face (or Par or Principal). The principal amount of a security that appears on the face of the bond.

Interest. Compensation paid or to be paid for the use of assets.

Issuer. The entity, typically a government or a government agency or authority, which initially offers bonds for sale to investors Often, the issuer is also the party responsible for making interest and principal payments on a bond, although sometimes that may be a different entity.

Liquidity (or Marketability). A measure of the relative ease and speed with which a security can be purchased or sold in a secondary market.

Maturity. The date when the par, or face, amount of a bond becomes due and payable.

Offering document (Official Statement or Prospectus). The disclosure document prepared by the issuer that gives detailed security and financial information about the issuer and the securities being issued.

Premium. The amount by which the price of a bond exceeds its par value.

Ratings. Designations used by credit rating agencies to give relative indications as to opinions of credit quality.

Secondary market. The market for issues previously offered or sold. There are nearly 4,000 banks and brokerage firms across the country that are registered to sell municipal bonds. An estimated $11.1 billion in municipal bonds are traded daily in the secondary market.

Yield (or Current yield). The annual percentage rate of return earned on a bond calculated by dividing the coupon interest rate by its purchase (market) price.

Zero-coupon bond. A bond for which no periodic interest payments are made. The investor receives one payment at maturity, equal to the principal invested plus interest earned, compounded semiannually, at the original interest rate to maturity.