February 27, 2018

American Enterprise Institute Conference on the The Taxpayer Protection Housing Finance Plan

Key Topics & Takeaways

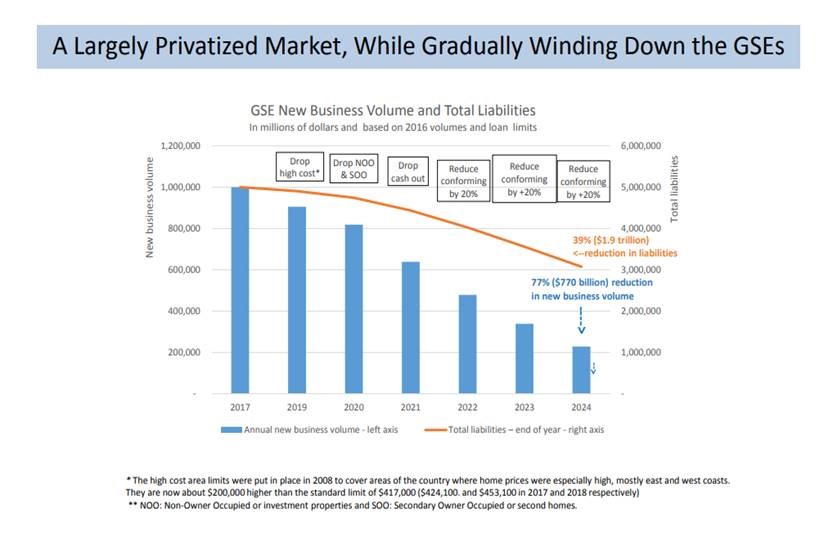

- Taxpayer Protection Housing Finance Plan: This plan calls for the gradual elimination of Fannie Mae and Freddie Mac (collectively, the GSEs) through administrative action. The plan envisions a gradual reduction in the conforming loan limits of the GSEs, beginning in high-cost area limits. Subsequent years would see the elimination of GSE involvement in the cash-out refinance market, the market for second homes, and “investor” loans for rental properties. A third phase would see a gradual reduction in standard conforming loan limits until the GSEs have exited the market completely. The authors argued that this change would not materially increase mortgage rates and would reduce risks to taxpayers, and that private capital is more than capable of meeting the demand for housing finance post-GSEs.

- To-Be-Announced Market: The plan argues that “life is possible” without the GSE TBA market. While the authors noted that the existing TBA market would become less liquid as the GSEs wound down, they argued that a private MBS TBA market would emerge to naturally, and the Ginnie Mae TBA market would remain to provide a hedge for lenders.

Participants

- Alex Pollock, Moderator, R Street Institute

- Peter Wallison, AEI

- Edward Pinto, AEI

- Tobias Peter, AEI

- Patrick Lawler, AEI

- Norbert Michel, Heritage Foundation

- Stephen Oliner, AEI

The Taxpayer Protection Housing Finance Plan

Overview

The central plank of the Taxpayer Protection Housing Finance Plan is for the Trump Administration to gradually eliminate Fannie Mae and Freddie Mac (the GSEs) through administrative action. The plan’s authors argued that the inability of Congress to pass meaningful housing finance reform legislation opens the door for GSE reform led by the next leader of the Federal Housing Finance Administration (FHFA). The plan itself also envisions a dramatically smaller role for the federal government in housing finance and a concomitant increase in private sector involvement.

Under this plan, the wind-down of the GSEs would occur piecemeal and at the direction of a future FHFA Director. The plan envisions a gradual reduction in the conforming loan limits of the GSEs, beginning in high-cost area limits. Subsequent years would see the elimination of GSE involvement in the cash-out refinance market, the market for second homes, and “investor” loans for rental properties. A third phase would see a gradual reduction in standard conforming loan limits until the GSEs have exited the market completely.

The authors argued that this change would not materially increase mortgage rates and would reduce risks to taxpayers. The plan also posited that the private-label mortgage-backed securities (PLS/MBS) market would revive as the GSEs withdrew, and that private-capital can meet the nation’s housing finance needs without government assistance. The plan argued that winding down the GSEs would slow home price growth, making affordable homes more available for low-and moderate-income borrowers. The authors also claimed that private mortgage insurance could create a market for securitized mortgages by providing coverage and setting industry standards for what constitutes a prime loan. Ginnie Mae was left largely intact by the plan, though the plan did call on the Federal Housing Administration (FHA) to make reductions in its conforming loan limits and impose other limitations on FHA programs to reduce Ginnie Mae’s footprint in the market overall.

See below for a graphic outlining the proposed elimination of the GSEs.

To-Be-Announced (TBA) Market

The plan argues that “life is possible” without the GSE TBA market. While the authors noted that the existing TBA market would become less liquid as the GSEs wound down, they argued that a private MBS TBA market would emerge to naturally, and the Ginnie Mae TBA market would remain to provide a hedge for lenders.

Problems with the GSEs

The presentation of the Taxpayer Protection Housing Finance plan discussed at length the perceived failings of the GSEs. Generally, the authors criticized the GSEs for 1) distorting prices in the housing market 2) not focusing operations on low-income, first-time homebuyers, and 3) encouraging excessive risk taking through their underwriting standards.

The first criticism of the GSEs focused on their impact on home prices. The authors argued that “affordable housing” mandates that regulators imposed on the GSEs prior to the 2008 financial crisis caused a dramatic increase in the amount of risky loans securitized by the GSEs and pushed home prices up as the increasingly large loans available pushed borrowers at all income levels in to higher-priced homes.

The authors drew much attention to the jumbo loan market, and they claimed that private jumbo loans offered lower interest rates to borrowers as compared to GSE loans, after controlling for the risk characteristics of the mortgages. They also noted that private-portfolio loans (including in the jumbo market) can also support 30-year fixed-rate mortgages and support borrowers at all loan sizes. The authors also claimed that the private mortgage market can support borrowers of modest means, and does so better than the GSEs.

AEI also presented data arguing that the GSEs activities are not primarily supportive of lower-income Americans’ home purchases. The presentation by the authors argued that only 6.5% of GSE funds were for first-time homebuyers of modest homes with most resources going to support investor homes, refinances, and well-to-do borrowers.

Market Impact of Eliminating GSEs

Much of the plan’s rationale for eliminating the GSEs is based around the idea that excessive risk-taking by the thinly-capitalized GSEs played a major role in the financial crisis. The authors posit that the GSEs are not necessary to prevent financial downturns and may exacerbate market risks with their activities. They also argued that FHA could continue to support qualified first-time homebuyers. Fundamentally, winding down the GSEs would slow down the growth in demand for housing, noting that when government programs increase demand for housing without increasing the supply of housing, prices can rise to dangerous levels, encouraging borrowers to take on leverage.

Mortgage Insurance

The authors argued that market-based enhancements could improve the attractiveness of PMBS. Broadly speaking, these enhancements were private mortgage insurance (PMI) that is bound by certain eligibility requirements, as well as property & casualty credit enhancement and credit risk transfer (CRT) of first-loss positions on PMBS. The authors said that riskier loans would need to be matched by private mortgage insurers holding additional assets to prevent a build-up of risk.

Treasury Savings

The plans authors also claimed that their proposal could eventually save taxpayers between $17-29 billion a year because by eliminating GSE MBS over time, as interest rates on Treasury bills would fall as overseas investors looking for safe assets would be pushed in to Treasuries. The authors also argued that the private market institutions’ balance sheets could absorb the size of the new MBS issuance, given how large the fixed-income markets are today.

For more information on this event, please click here.