An Example of How TIPS Work

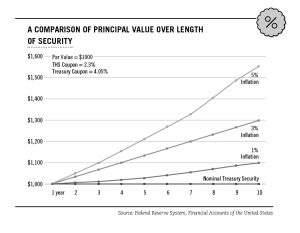

Suppose an individual invests $1,000 on January 15 in a new inflation-protected 10-year note with a 3% real rate of return.

- If inflation was 1% during the first six months of that year, then by mid-year the inflation-adjusted principal amount of the security would be $1,010. ($1,000 x 1.01 = $1,010).

- In addition, at mid-year, on July 15, the investor would receive the first semiannual interest payment of $15.15 ($1,010 times 3% divided by 2).

- Suppose, then, that inflation accelerated during the second half of the year, so that it reached 3% for the full year.

- By the second semiannual interest payment date, January 15, the inflation-adjusted principal amount of the security would be $1,030. ($1,000 x 1.03 = $1,030).

- The second semiannual interest payment would be $15.45 ($1,030 times 3% divided by 2).